With venture capital funding drying up due to Covid, many startups found themselves on the lookout for alternative funding structures that do not require diluting equity. And rightly so, because equity dilution is expensive in the long run.

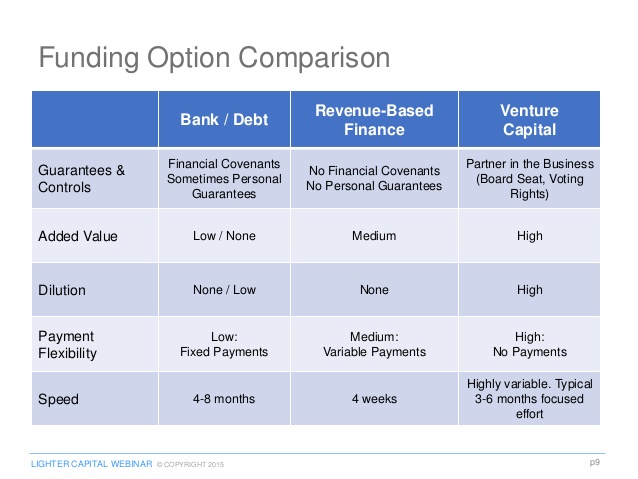

And herein came the moment of truth for Revenue Based Financing. Revenue Based Financing (RBF) is a type of revenue share or profit share funding structure that has started gaining traction over the past few years. Unlike equity funding, an RBF is a fixed sum that is repaid over a period of time from the incoming revenue the company generates. Startups receive funds from investors to spend on marketing or working capital or any strategic need, and the funds are returned back to the investors from every sale the company makes.

Allow me to explain very simply

Let’s say an eCommerce company is generating Rs 12 lacs in monthly revenue and requires capital to build out their inventory and spend on advertising. With a ROAS (return on ad spends) of 3.5, they can generate Rs 3.5 in revenues for every rupee they spend on ads. This eCommerce company has a healthy 60% gross margin and has fixed costs of Rs 6 lacs.

Equity raise

In case of a regular equity raise, the company may receive a max 10x ARR multiple in terms of valuation. In this case, 12 lacs x 12 = ~1.5 cr ARR, and ARR x 10 = a max valuation of 15 cr. If the founders dilute ~20% then they can raise up to 3 cr.

If they spend 40% of the funds in marketing, at ROAS of 3.5, the company can generate ~5 cr in sales in the coming 12-18 months. With a 60% gross margin, and an inflated fixed cost base of 15 lacs per month [because VCs love it when you experiment (10% funds), grow the team (20% funds) and add new products (10%), and the rest is working capital (30% of funds)], they will be at an MRR of 40-45 lacs and breaking even, and again in need of funds in 18 months.

RBF route

Now, if they would have opted for the RBF route, the company could have received up to 10x MRR or ~1.2 cr in funds from investors. RBF funds are typically for very specific needs of the company like working capital or marketing spends. If this company spends 65% of funds received for marketing and the balance on working capital, it has 70-75 lacs to solely focus on marketing that can potentially take them to ~25-30 lacs in monthly revenues without diluting equity. They pay investors only from the revenues they generate (typically 5-10% of monthly revenue) and retain entire equity with themselves. Say for example the company generates 20 lacs of sales, they pay the investor 20 lacs x 7.5% = 1.5 lacs that month. If they generate 40 lacs, they pay 40 lacs x 7.5% = 3 lacs that month. They pay this revenue-based return back to investors every month until they pay the pre-determined IRR which is usually 25-35%.

VC funding

A couple of years later, with much better traction, they can raise a large round of equity from VCs and pay off the RBF instrument. RBF is kind of a rocket fuel capital infusion that gives founders immediate cash for growth without having to dilute equity. There are also no fees involved typically so the company gets the entirety of the cash.

Our views on RBF

RBF is a growing trend especially for eCommerce and SAAS companies that enjoy healthy gross margins. At Malpani Ventures, we have successfully exited an RBF in a SAAS company generating a 30% IRR in a span of 16 months. During this period the company was able to use funds to grow its marketing initiatives and cross over a million dollars in ARR with founders retaining a good majority of their stakes.

We are always on the lookout to explore RBF opportunities in the eCommerce & SAAS space. Prospective founders are encouraged to read more about our RBF thesis here. Please reach out to us if you think we are the right investors for you! We want to work with founders who can create win-win outcomes for everyone!